The No Surprises Act (NSA) is a federal law which went into effect on January 1, 2022. The law bans surprise medical bills for emergency services and elective care when the patient does not have a choice of ancillary service providers in an in-network facility.

The Department of Health and Human Services (HHS) has realized that not all aspects of the NSA will be able to be implemented by providers and facilities by January 1, 2022, so they have elected to exercise “enforcement discretion” on portions of the act in 2022. To be in compliance in 2022, healthcare providers and health care facilities must be prepared to:

- Publicize and disseminate a “Disclosure Notice” which informs beneficiaries of group health plans of their rights under the No Surprises Act; and

- Publicize and disseminate a “Right to Receive a Good Faith Estimate” to uninsured or self-pay patients; and

- Provide uninsured or self-pay patients with a good faith estimate (within a $400 threshold) of services that will be billed by the “convening” provider or facility.

- Present a Notice and Consent form, with an estimate of charges, to a beneficiary of a group health plan who chooses to receive services from an out-of-network facility or provider and submit a claim to the health plan.

Disclosure Notice

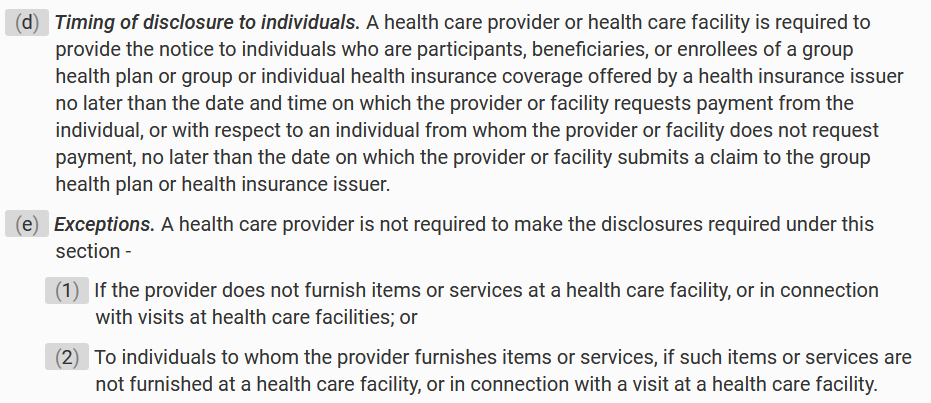

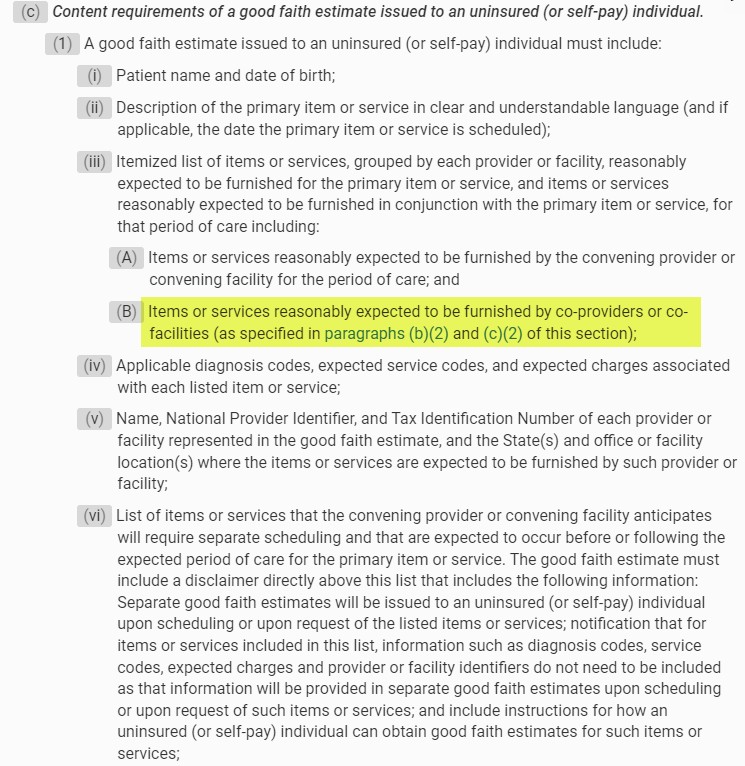

As of January 1, 2022, the disclosure notice must be prominently displayed on websites, in public areas of an office or facility, and on a one-page (double-sided) notice provided in-person or through mail or e-mail, as chosen by the patient. The disclosure notice must be provided to all commercially insured patients after January 1, 2022, or before that date if the elective service will be provided after January 1, 2022. The notice must be provided before requesting a payment from the insured or before a claim is submitted on behalf insured.

In states where there are state laws that protect patients against surprise billing, providers and facilities can use a state disclosure notice if it meets or exceeds the federal guidelines. If a provider or facility drafts their own disclosure notice it must include these three points:

- Restrictions on providers and facilities regarding balance billing in certain circumstances

- Any applicable state laws protecting against balance billing

- Contact information for appropriate state and federal agencies if the individual believes their rights have been violated

Right to Receive a Good Faith Estimate Notice

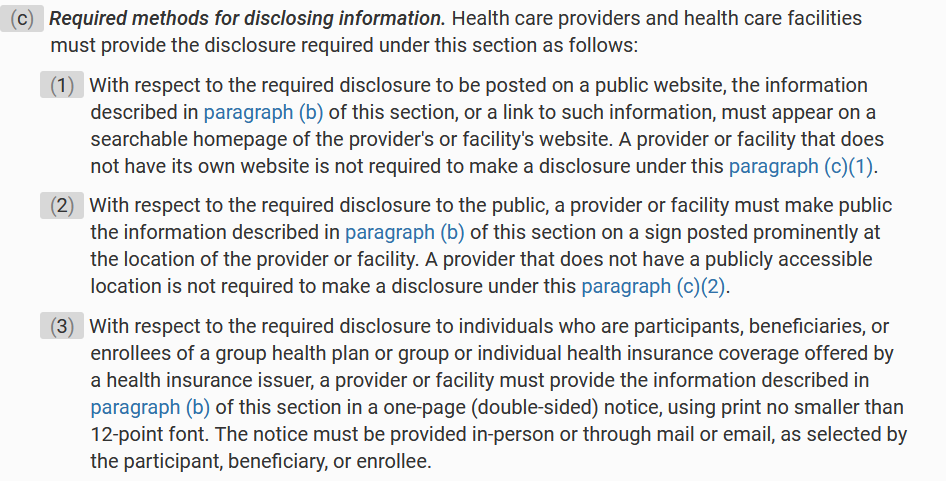

All uninsured or self-pay individuals must be made aware, both orally and in writing, of their right to receive a good faith estimate for any services that will be rendered beginning January 1, 2022. The form must be prominently displayed on websites, in offices, and where scheduling or questions about the cost of health care may occur.

Good Faith Estimates to Uninsured/Self Pay

When discussing the good faith estimate it is important to know a few terms:

- A health care provider (provider) is defined as a physician or other health care provider who is acting within the scope of practice of that provider’s license or certification under applicable State law.

- A health care facility (facility) is defined as a hospital or hospital outpatient department, critical access hospital, ambulatory surgical center, rural health center, federally qualified health center, laboratory, or imaging center that is licensed as an institution pursuant to State laws or is approved by the agency of such State or locality responsible for licensing such institution as meeting the standards established for such licensing.

- The convening provider or facility is the one who receives the initial request for a good faith estimate from an uninsured or self-pay individual and who is or, in the case of a request, would be responsible for scheduling the primary item or service.

- A co-provider or co-facility furnishes items or services that are customarily provided in conjunction with the convening provider.

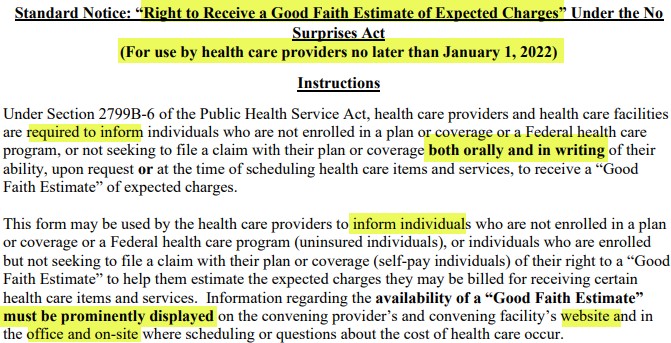

An uninsured patient is an individual who does not have benefits for an item or service under a group health plan; whereas a self-pay patient is an individual who has benefits under a group health plan but chooses not to have a claim submitted to their plan. The good faith estimate presented to an uninsured or self-pay patient must include services reasonably expected to be provided by the convening provider or facility. At this time, estimates for services provided by co-providers and co-facilities do not have to be provided by the convening provider or facility.

The following list was provided in the interim final rule published in the Code of Federal Regulations. CMS followed up with a Fact Sheet that clarifies HHS will not be enforcing the requirement of including services provided by co-providers or co-facilities.

A good faith estimate must include:

- Patient name and date of birth

- Description of the primary item or service

- Itemized list of items or services reasonably expected to be furnished

- Items or services reasonably expected to be furnished by the convening provider or convening facility for the period of care; and

- Items or services reasonably expected to be furnished by co-providers or co-facilities

- Applicable diagnosis codes, expected service codes, and expected charges associated with each listed item or service

- Name, National Provider Identifier, and Tax Identification Number of each provider or facility represented in the good faith estimate, and the State(s) and office or facility location(s) where the items or services are expected to be furnished by such provider or facility

- List of items or services that the convening provider or convening facility anticipates will require separate scheduling

eCFR :: 45 CFR Part 149 — Surprise Billing and Transparency Requirements

Requirements Related to Surprise Billing; Part II Interim Final Rule with Comment Period | CMS

The Good Faith Estimate process that requires facilities and providers to transmit estimates to health plans, is still on hold.

Notice and Consent

The Notice and Consent is being enforced for those rare instances when the patient has a choice of providers and chooses to receive services from an out-of-network facility or provider. Situations when a patient does not have a choice of providers and cannot be requested to sign a consent waiving their balance billing protections in an in-network facility are:

- When receiving services that are considered ancillary services:

- Items and services related to emergency medicine, anesthesiology, pathology, radiology, and neonatology

- Items and services provided by assistant surgeons, hospitalists, and intensivists

- diagnostic services, including radiology and laboratory services

- Items and services provided by a nonparticipating provider if there is no participating provider who can furnish such item or service at such facility

Balance billing is prohibited in all emergency situations, even those that arise during a service that is being provided under a written consent. Any charges related to that emergency cannot be balance billed until the patient is deemed stable, as defined in the NSA – able to transport to another facility by nonmedical transportation. In the event the patient requires a higher level of care that requires transport, the EMTALA guidelines take precedence.

A patient admitted to an out-of-network facility from an emergency department who is then considered stable, must be presented with a notice and consent if they choose to continue treatment in the out-of- network facility. If the consent is signed, the out-of-network facility can balance bill for charges incurred after the provider documents that patient is stable, as defined in the NSA – able to transport to another facility by nonmedical transportation. Ancillary services cannot balance bill even after the patient is considered stable.

eCFR :: 45 CFR Part 149 Subpart E — Health Care Provider, Health Care Facility, and Air Ambulance Service Provider Requirements

The Notice and Consent form, with an estimate of all charges, must be presented to the patient for a signature.

- This form must be available in the 15 most common languages in the geographical area. If the individual’s preferred language is not among those 15, a qualified interpreter must be made available to assist the patient with understanding their rights.

- The form must be provided at least 72 hours prior to scheduled services, when they are scheduled at least 72 hours out. When services are scheduled and performed on the same day, the document is required to be presented at least 3 hours before the services are rendered.

- The patient must be provided with a signed copy and a signed copy must be maintained in the medical record in the same manner as all other required documented.

ParaRev can Help

ParaRev has an online tool that can assist with estimates and notices. To learn more, contact us at 800-999-3332 and ask to speak with an Account Executive for more information.

ParaRev offers a full spectrum of healthcare revenue cycle management services, from front-end charge master analysis and contract management to end-of-cycle zero-balance denial recovery. We’re committed to working seamlessly with hospital financial and billing staff to minimize denials and bad debt, improve collections and boost revenues.

ParaRev’s comprehensive capabilities, when aligned with hospital internal teams, can help hospitals improve operating margins and collect additional revenue. Contact us to learn how we can help your facility meet the requirements of the No Surprises Act.

Revenue Cycle Executive Game Plan: Proven Automation Strategies that Deliver Results

Download our free whitepaper to learn how a 6-step end-to-end action plan can transform your revenue cycle operations.